Act now to stop the CII coup

As a member of the Personal Finance Society, you will have recently received a deeply troubling email from Alan Vallance, CEO of the Chartered Insurance Institute.

The implied message contained within is clear – the CII intend to flood the PFS board and and force a vote to deregister the PFS as a professional body.

Alan Vallance has publicly stated the deregistration is not on the agenda. We are providing information about CII and PFS finances, and will leave you to make your own mind up. See CII Misinformation for further details.

We do not want to be subsumed by a professional body of insurance practitioners.

We will not be treated as a cash-cow

Make your voice heard.

It’s all about the money

The PFS is responsible for the vast majority of CII “group” revenues, and all of the surplus.

When exam fees are included, we estimate this to be over 60% of group revenue.

There is £19 million of surplus revenue, which was paid by, and belongs to, the PFS membership.

Without these funds, the CII will most likely be insolvent.

They need PFS members more than PFS members need them.

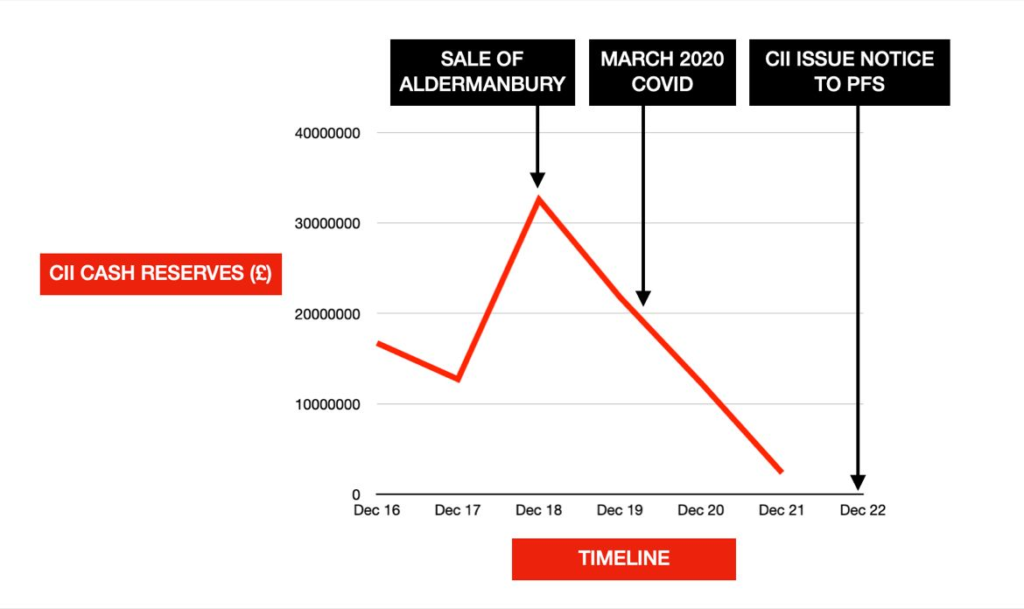

The image below shows the cash reserves of the CII entity, (credit Vanessa Barnes)

Additionally, Daniel Elkington at Keep it Easy Financial Planning conducted an investigation into the CII’s accounts. The full details can be read here.

Daniel’s conclusion reads:

Overall, the recommendation has to be that the real conflict of interest here is between the insurance institute and the personal finance society. Therefore, the CII must become a proper group of companies. With the PFS, the Institute, and the school being separated into three distinct entities that are regulated by the overall group.

The conflict we have is that the institute is both the group, and representative of insurance companies members, this conflict has led to a forced takeover because of a dispute between insurance and personal finance. The problem is the mediator in this dispute is conflicted as the mediator is one of the parties to the dispute.

Simply put, it is as though you’re being sued by a judge, and when you get to court not only are they representing themselves, they are also judging the case. The fact that the CII have failed to recognise this conflict, or indeed their own deficiences, is incredibly worrying and why personal finance has to fight this.